What Does Behind the Scenes: Exploring the Journey of Obtaining Copies of Your Bankruptcy Documents Mean?

The Ultimate Checklist for Recovering Your Bankruptcy Paperwork

Filing for bankruptcy can easily be a complicated and difficult method. It entails gathering and submitting a notable volume of documents to sustain your situation. Nonetheless, the journey doesn't end once you've filed for bankruptcy. In truth, there may come a time when you require to retrieve your bankruptcy documents for numerous factors, such as getting money or providing paperwork to prospective employers.

To aid produce This Author , we have organized the best check-list for recovering your personal bankruptcy documentation. By observing these measures, you may guarantee that you have all the important papers in palm when the demand arises.

1. Recognize What Records You Need

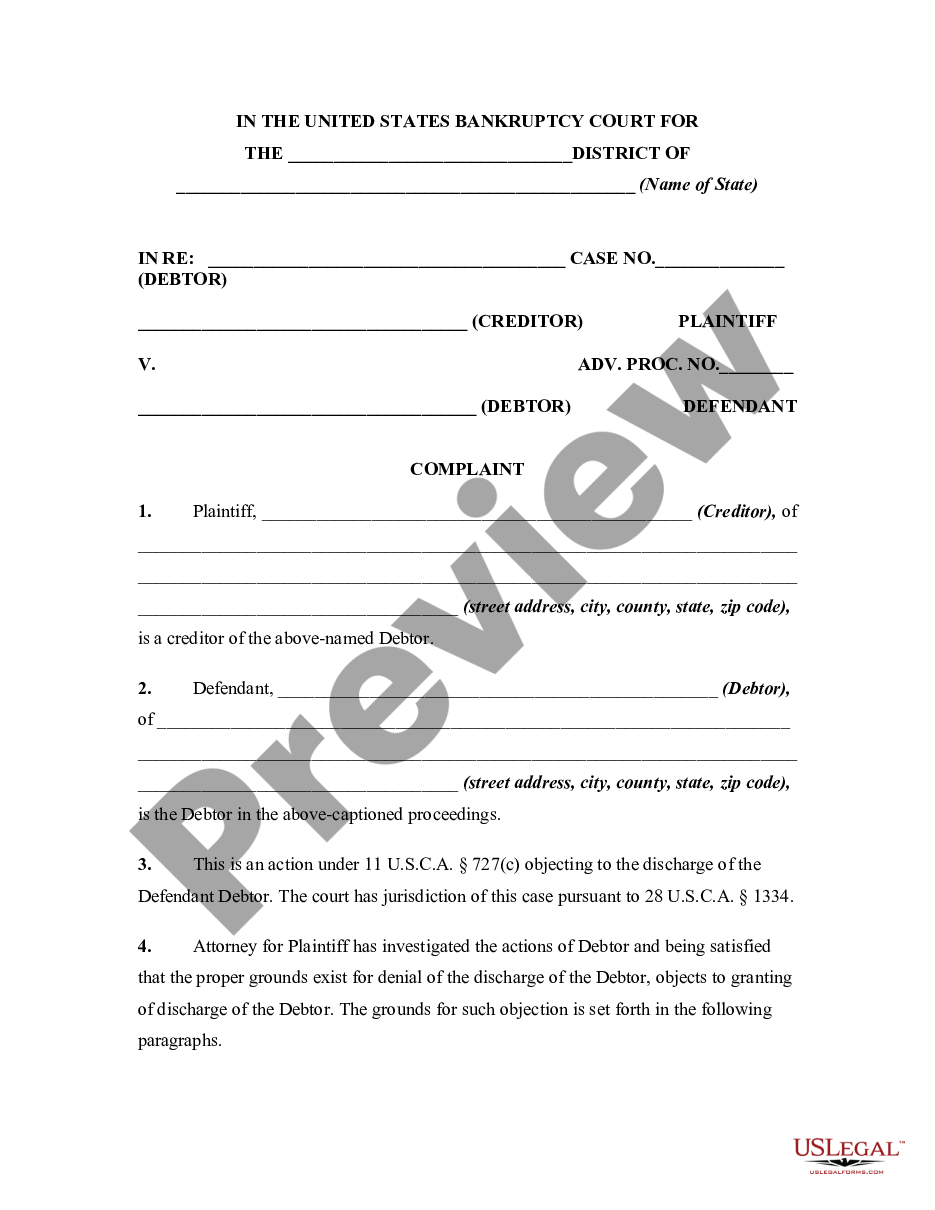

The very first measure in getting your insolvency documentation is understanding what papers are required. This will certainly differ depending on the kind of bankruptcy you submitted (Chapter 7 or Phase 13) and the certain details of your instance. Commonly, you will require copies of your personal bankruptcy request, routines listing your possessions and financial debts, collector mailing list, ejection purchase (if suitable), and any sort of other applicable court purchases or papers.

2. Situate Your Bankruptcy Case Number

Your insolvency situation variety is crucial in obtaining your documents as it offers as a reference aspect for court team when exploring with their files. If you don't have this details readily available, contact the court of law where your instance was submitted to acquire it.

3. Get in touch with The Bankruptcy Court Clerk's Office

Once armed along with your case number, get to out to the clerk's workplace of the personal bankruptcy court of law where your scenario was took care of. They will definitely guide you through the method of retrieving duplicates of your documentation and deliver any kind of essential types or guidelines.

4. Calculate The Court's Retrieval Process

Each court of law may possess its personal certain procedures for obtaining personal bankruptcy paperwork. Some courts provide internet access to digital records while others require written asks for or physical sees to get duplicates. Inform yourself with these treatments to make certain a soft retrieval procedure.

5. Fill up Out The Necessary Forms

If required, finish any kinds delivered through the court to seek duplicates of your bankruptcy documentation. These types commonly ask for your personal info, case variety, and the details documents you require. Make certain that you pack out all the required industries efficiently to prevent any sort of hold-ups or errors.

6. Pay out The Required Expenses

In the majority of scenarios, there are fees associated along with fetching insolvency paperwork. The court might bill a per-page cost or a flat expense for duplicates of your documents. Determine the expense included and make certain to consist of remittance along along with your ask for.

7. Provide Sufficient Recognition

To guard against unwarranted get access to to delicate details, courts typically call for individuals seeking insolvency paperwork to deliver ample id. This could include a authentic image I.d. or various other pinpointing documentations such as a social security memory card or chauffeur's certificate.

8. Permit Ample Time For Handling

Depending on the workload of the court clerk's office and the accessibility of resources, it might take some opportunity for your demand to be processed. Be patient and make it possible for sufficient opportunity for the court workers to find and replicate your asked for documentations.

9. Double-Check Your Sought Documentations

Once you receive copies of your insolvency documents, very carefully assess each file to ensure that it consists of all relevant web pages and is readable. If you recognize any type of differences or missing web pages, contact the employee's workplace instantly for settlement.

10. Store Copies Of Your Bankruptcy Paperwork Securely

Once you have gotten your insolvency paperwork, it is necessary to keep them safely and securely in an organized way. Keep both electronic and bodily copies in a risk-free area where they may be conveniently accessed when required in the future.

In final thought, getting your insolvency documentation doesn't have to be a daunting job if you follow this greatest check-list. Understanding what documents are required, talking to the clerk's workplace, loading out essential kinds accurately, paying out fees immediately, giving id when required, enabling adequate handling opportunity, double-checking acquired documentations, and saving copies securely will certainly guarantee that you have all the important documents quickly accessible whenever you need to have it.